W-4 Processing Enhancements

A new Tax Requests feature in eHR lets employees submit updates to their W-4 federal tax withholding information online.

The following step-by-step tutorial shows you how to set up and use this feature:

Add the Tax Requests option to the My HR menu

-

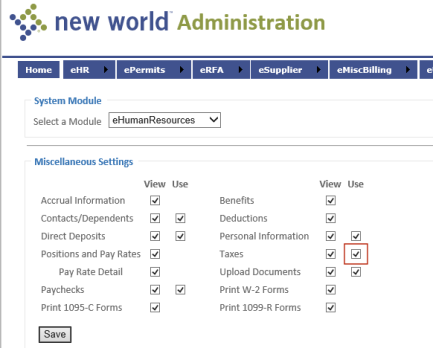

In eAdministration, navigate to eHR > eEmployee >

Miscellaneous Settings page.

Miscellaneous Settings page. - A Use check box has been added to the Taxes setting. Select this box to add the Tax Requests option to the My HR menu on the eSuite HR Portal.

Add custom messages to the Tax Request pages

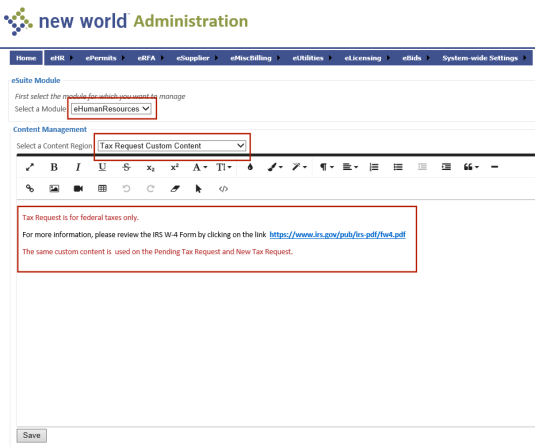

- In eAdministration, navigate to eHR > eEmployee > Content Configuration.

- In the Select a Module field, select eHumanResources.

-

In the Select a Content Region field, select the new

Tax Request Custom Content option. The custom content area loads below the field.

Tax Request Custom Content option. The custom content area loads below the field. - Use this area to add messages, reminders or any other type of information you want to appear on the [pages].

- Click Save.

-

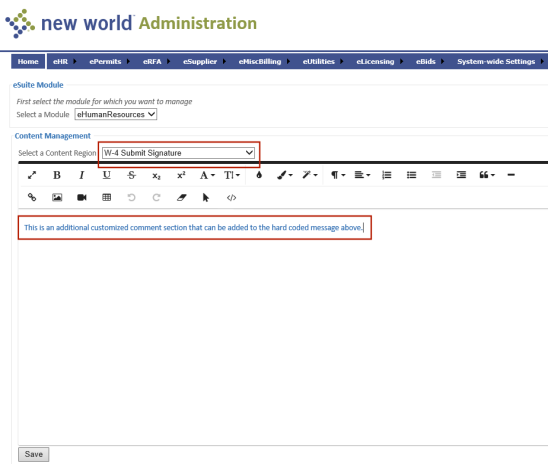

In the Select a Content Region field, select the new

W-4 Submit Signature option.

W-4 Submit Signature option. -

In the custom content area, add what you want to appear on the Confirm dialog that appears when an employee submits a W-4 update.

Note: Above your custom content, the following statement will appear automatically on the Confirm dialog and cannot be changed: "Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, it is true, correct, and complete."

- Click Save.

Base tax change on check date or pay end date

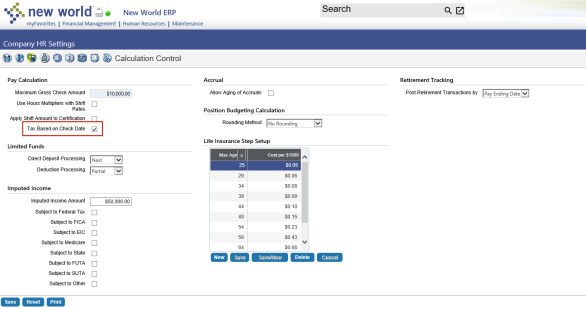

- To determine whether the effective date of a W-4 tax change occurs on the check date or pay end date, navigate to Maintenance > Human Resources > Company HR Settings.

- Click the Calculation Control icon at the top of the page.

-

To have the tax change occur on the check date, select the

Tax Based on Check Date check box. To have the change occur on the pay end date, deselect this box.

Tax Based on Check Date check box. To have the change occur on the pay end date, deselect this box. - Click Save.

Will W-4 updates require approvals?

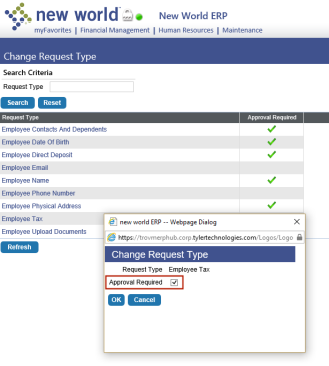

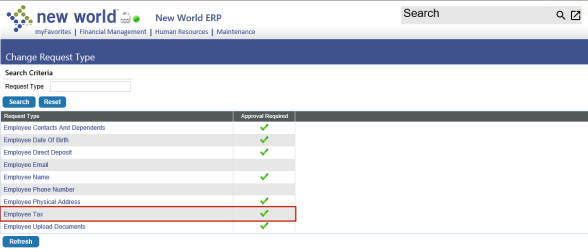

- If you want approvals to be required for W-4 updates, navigate to Security > Change Request Type. The Change Request Type page opens.

-

Scroll down to the new Employee Tax request type and click it. The

Change Request Type dialog opens.

Change Request Type dialog opens. - If you use the Process Manager approval process and want approvals to be required, select the Approval Required check box. If not, deselect it.

-

Click OK. If you selected the box, a

green check mark appears in the Approval Required column of the grid.

green check mark appears in the Approval Required column of the grid.

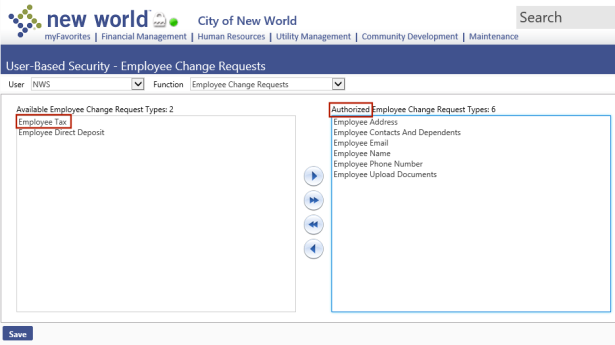

Secure change request types

-

To give a user access to the Employee Tax change request type, navigate to Security > User-Based Security.

- Select the Employee Change Requests function.

- Move Employee Tax from the Available list box to the Authorized list box.

- Click Save.

Select permissions to W-4 documents

- To select the type(s) of permission a user will have to W-4 documents, navigate to Security > Users.

- Select the user.

- Click the Permissions button. The User Permissions page opens.

- In the Search Security Components field of the Filter panel, type workforce administration documents. The Permissions panel refreshes to contain the Workforce Administration Documents security component.

- Select the appropriate permissions.

- Click Save.

- In the Search Security Components field, type employee tax documents. The Permissions panel refreshes to contain the Employee Tax Documents component.

- Select the appropriate permissions.

- Click Save.

- For the permissions to take effect, the user needs to sign off and sign back onto the system.

Set up withholding status alternate values

To determine how the withholding status box is selected on the W-4, set up alternate values for the Withholding Status validation set. Follow the steps below, making the entries exactly as shown:

- Navigate to System > Validation Sets > Validation Set List.

- Select Set Number 11, Withholding Status.

- Click the Values button. The Validation Set Values List page opens.

- Select the row containing a federal withholding status.

- Click the Alternates button. The Alternate Value List page opens.

- Click the New button. The Alternate Value dialog opens.

-

Select the Usage Type, NWS Quick Value.

- In the Value field, type an M.

- In the Description field, type Married.

- Click OK.

-

Repeat steps 4-10 for the following withholding statuses:

Alternate Value Description (Status) M Married S Single H Head of Household M2 Married 2 Jobs S2 Single 2 Jobs H2 HOH 2 Jobs

-

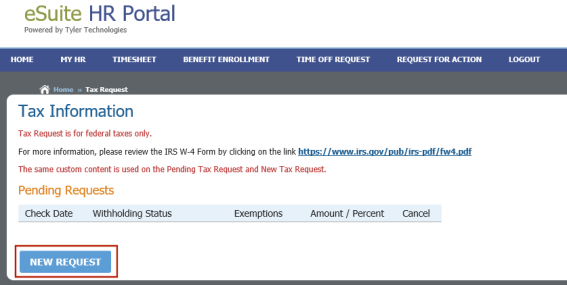

From the eSuite HR Portal, select the

Tax Requests option on the My HR Menu.

Tax Requests option on the My HR Menu.The

Tax Information page opens.

Tax Information page opens. -

Click the

NEW REQUEST button.

NEW REQUEST button.The

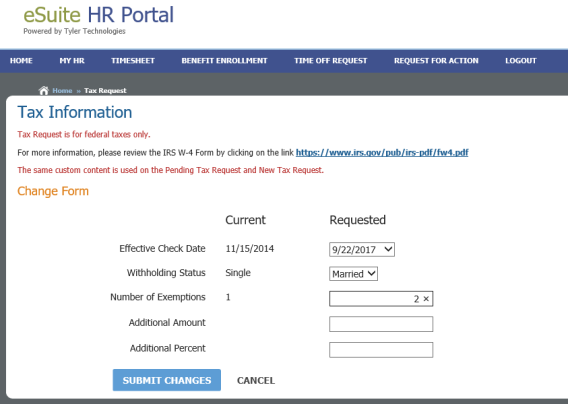

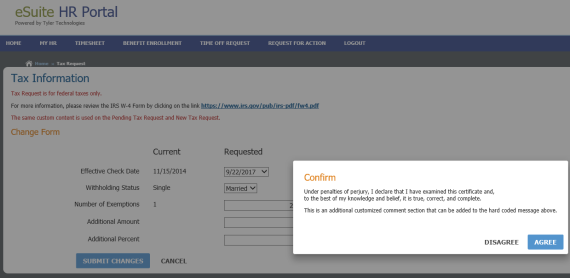

Tax Information Change Form opens, containing a Current column showing the current W-4 selections and a Requested column for making new selections. The top three fields require selections.

Tax Information Change Form opens, containing a Current column showing the current W-4 selections and a Requested column for making new selections. The top three fields require selections. - Select the Effective Check Date. Starting with the first effective check date from today's date, the drop-down contains the effective check dates of the next ten pay batches.

- Select a Withholding Status. The drop-down contains only the statuses that have been set up for federal withholding.

- Select the Number of Exemptions.

- Use the Additional Amount field if you want an additional dollar amount withheld from pay checks, the Additional Percent field if you want an additional percent withheld.

-

When satisfied with your changes, click the SUBMIT CHANGES button. A

Confirm dialog opens, serving as your electronic signature.

Confirm dialog opens, serving as your electronic signature.This dialog may contain custom content that was added through the Content Configuration option in eAdministration.

-

If you agree with the statement on the dialog, click AGREE, and the changes will be submitted and validated; otherwise, click DISAGREE. If you agree with the changes, the

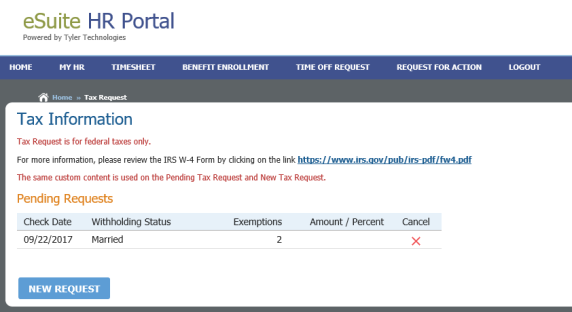

Tax Information page reopens, and the grid shows your request as pending.

Tax Information page reopens, and the grid shows your request as pending.If you want to cancel the request, click the red X in the Cancel column.

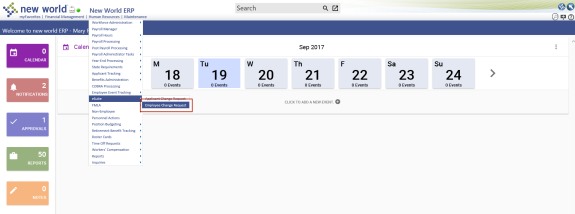

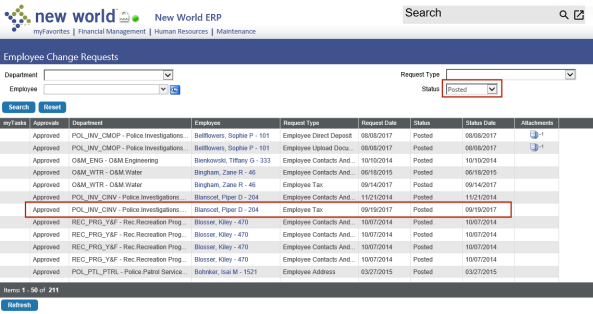

- Log in to new world ERP.

-

Navigate to

Human Resources > eSuite > Employee Change Request. The Employee Change Requests page opens.

Human Resources > eSuite > Employee Change Request. The Employee Change Requests page opens. -

Click the

Employee name in the row representing the change request.

Employee name in the row representing the change request.Note: The Request Type column will show the new request type of Employee Tax.

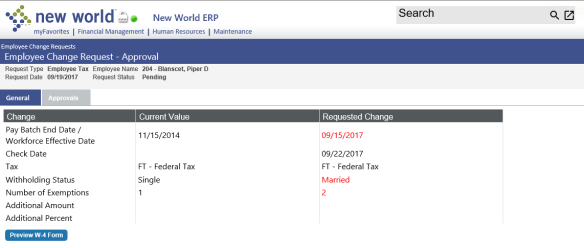

The

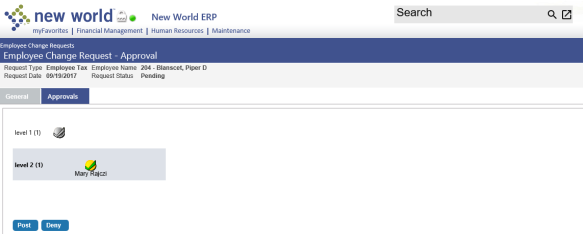

Employee Change Request-Approval page for the Employee Tax Request Type opens, containing two tabs, General and Approvals. The grid on the General tab shows the requested changes in red.

Employee Change Request-Approval page for the Employee Tax Request Type opens, containing two tabs, General and Approvals. The grid on the General tab shows the requested changes in red. Note: When the change request is posted (step 6), an event for the new effective date is created in the employee's Workforce Administration Taxes section.

- To preview the W-4 form pending approval, click the Preview W-4 Form button.

-

Click the

Approvals tab. This tab contains two buttons, Approve and Deny.

Approvals tab. This tab contains two buttons, Approve and Deny. - To approve the change, click the Approve button. The Add Approval dialog opens, giving you the options to select users at the next approval level, if applicable, and add comments.

-

Click OK. The approver icon turns yellow, the name of the approver is displayed, and a

Post button replaces the Approve button. If email notifications have been configured, an email is sent to the employee.

Post button replaces the Approve button. If email notifications have been configured, an email is sent to the employee. -

To post the change request and update the employee's Workforce Administration Taxes section, click the Post button. The buttons are removed from the tab, and the change request is updated to a

posted status. To view a posted change, click the Show Search link in the top-right corner of the Employee Change Requests page, select Posted in the Status field, and click Search.

posted status. To view a posted change, click the Show Search link in the top-right corner of the Employee Change Requests page, select Posted in the Status field, and click Search.

- Log in to New World ERP.

- Navigate to Human Resources > Workforce Administration > Search.

- Search for the employee.

- Click the Employee Number. The Employee's Workforce page opens.

- Click the Payroll Data tab.

- In the Quick Links section on the left side of the page, click Taxes.

-

In the

Taxes grid, the top row should correspond with the new withholding status.

Taxes grid, the top row should correspond with the new withholding status.

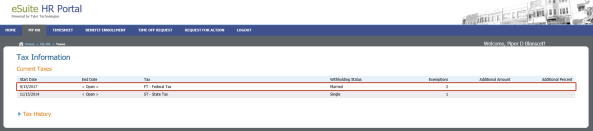

- Log in to the HR Portal.

- Navigate to MY HR > Taxes. The Tax Information page opens.

-

In the

Current Taxes grid, the top row should correspond with the new withholding status.

Current Taxes grid, the top row should correspond with the new withholding status.